How History Spends Our Loans

Ancient times

Are you went on business. Of course, back then people didn’t trade in gold or silver – there was no fiddling around making a deposit, trying to be rid of your small change. These temples dealt in grain and livestock. Other cultures swapped ivory, feathers, beaver pelts. A little later, in the days of Henry I, currency came in the form of sticks, notched with tally marks to indicate their value.

Things have moved on a bit since then, but the basics are still the same. You have your cash, you need to store it, you go to the bank. You need a little extra cash to buy a car, or pay a deposit on a house – you go back to the bank and ask nicely. Should your credit history be reputable, you take out your loan and spend it as need be.

19th Century

More recent history has brought other changes, both in how we take out loans and what we spend them on. Since 1915 in the United States, according to Monthly Labour Review, family expenditure on food has halved. Homeownerships – and therefore the number of people taking out mortgage loans, and loans for deposits – have doubled. Medical, recreational and transportation spending (cars are expensive creatures) has increased significantly.

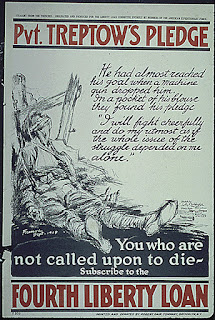

The reasons for these changes are manifold. Wars are even more expensive than cars, and have all sorts of knock on affects. We had a couple of pretty big ones during the first half of the twentieth century, and the second half, going into the twenty-first, brought Korea, Vietnam, Iraq (twice) and Afghanistan.

These have accompanied both booms and busts – from the Great Depression to the not so great recessions, from energy crises resulting in petrol prices rocketing, resulting in more money used on fuel, resulting on money used on other things needing to come from other places, resulting in… you get the picture. Demography is a big factor too – one-family households and single parenthoods have increased, and these have different demands than a so-called ‘nuclear’ family. The average age of a society has its own peaks and troughs, and depending on whether you’re a young, middle-aged or senior citizen, you have different needs.

The Financial collapse of 2007

In very recent times a near-worldwide recession has hit hard, and the use of payday loans has shifted. Traditionally, these have often been used for emergencies, however ‘emergency’ may be defined. Perhaps the electric bill has doubled, or you’re about to have your car repossessed. However, The Telegraph recently reported that, despite many consumers giving fewer presents this Christmas, many more adults are taking out payday loans to cover the festive costs.

One big change in the last few decades is the increase in young people seeking further education. This brought with it the necessity of different loans for different means. Want to do an undergraduate degree? You might struggle without a student loan to pay for course fees, food or rent. In the United Kingdom, with the recent increase in tuition fees – in many cases up to £9000 per year – these types of loans are more essential than ever. And if you embark on a postgraduate degree then you may want to take out a career development loan to help cover those same costs – fees, food, living.

Our times

Then there are the technological developments. Used to be that if you wanted a loan you had to get yourself to the bank and arrange appointments and have to wait weeks or even months to get things moving. Nowadays you can just pick up the phone, or hop on the internet, and sort out a loan in hours.

All these factors – demographics, wars, technology – are a product of history, and history has contributed to the changing ways we take out and spend our loans. No doubt future events will have further unanticipated effects. All we can do is wait, spend, and see.