Introduction to Reading Doji Candle Stick Patterns

The Doji Candlestick Pattern

Candlestick Patterns are a commonly used tool in the Forex Market, considered to be one of the most effective and reliable indicators. Doji Candlestick is one of the derivatives of the Candlestick Pattern. It is an easily recognizable in the market because it has no body. Being easy to spot makes it easy to use for all the traders. This pattern means that there has been no change in the prices from the opening to the closing of the trade. The candlestick using the Doji pattern has wicks but the candlestick itself is not there.

Reliability and Accuracy of the Candlestick Patterns

The Candlestick Patterns are considered to be so reliable because of their accuracy and precision. It is as they can be used in any market conditions which are prevalent. Unlike the other indicators which are restricted to efficiency in certain market conditions only. In the Forex Market, it is a vital asset to be used and the simplicity of it makes it a favorite of the Forex Traders. There are many indicators which are used in the Forex Market and they vary with degree of complexity. The Candlestick is one of the simplest and uncomplicated ones.

How to Identify a Doji

Coming back to the Doji Candlestick, it can be spotted clearly because it is in the shape of a cross on the chart. See a cross and you will get to know that the opening and closing prices remained the same. It is a rare event which means that you cannot see the Doji being depicted in the charts on a regular basis. You will be able to see it once in a blue moon.

What the Doji shows

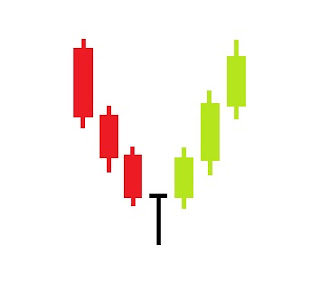

The Doji pattern can be used as a trading signal for the Forex Traders. For it to occur, it is imperative that the price closes on the same level where it started. A lot of trading takes place during an average day in the Forex Market, where over three trillion dollars are exchanged on a daily basis. What the Doji shows is that the Bulls and Bears were equally powerful during the day trading and no clear winner came through. It is an uncommon occurrence and you can expect that the trend will reverse or change soon afterwards and the market will go into a bullish or a bearish trend instead of being neutral.

There are a couple of variations to the Doji Candlestick Pattern.

Dragonfly Doji

The Dragonfly Doji is the first variation to the Doji pattern and occurs on the charts when the opening, closing and the highest prices are equal. It is even rarer than when a standard Doji is formed, which means that you might be able to see a Doji but a Dragonfly Doji would be very difficult. The formation of the dragonfly is quite simple to understand. It forms when the price goes downwards during the early trades. A day is a long time in the Forex Market and after going down, the price starts going back again. There is a chance that a price can be salvaged at any time in the market. Since the price went downwards at the start, it will only go up towards the highest level for the day. If it closes at the highest level, then it means that the closing price and the high price will be equal to each other and a Dragonfly Doji will be formed. It is imperative that the closing price should be the same as the opening price. The Dragonfly will be formed when the Forex Market is bullish.

Bearish Gravestone Doji

The second variation of the Doji is the Bearish Gravestone Doji. As seen from the name, it is formed when the Forex Market is in a bearish trend. It is the polar opposite of the Dragonfly and is formed when the opening, closing and the lowest price for the day are equal. When you see a Bearish Gravestone Doji, beware that the market is going to go on a strong downtrend, which is going to go for a long time. A Bearish Gravestone will be formed when the price during a day initially goes upwards and then cracks and goes on a downward spiral and closes on the lowest point, which is equal to the opening price.

It’s strange, that sometimes the most simple suggestions are often the most useful! I will take the above mentioned tips into approach and wait to see the final results. Thank you for submitting this page!