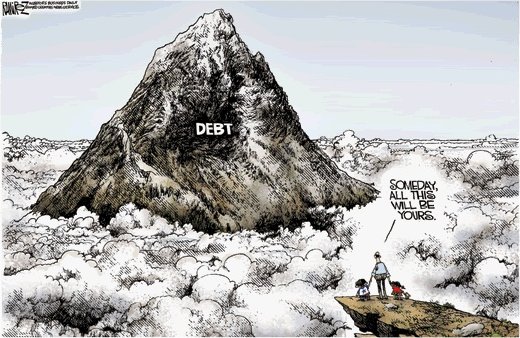

Simple Ways to Gain Control of Your Mounting Debt

If debt has started to rule your thoughts and dreams at night, causing stress and anxiety at a undeniable level, then it is probably time to start considering how to get a handle on your debt. There are many do-it-yourself tricks and tips along with hundreds of professionals ready to help you with just a phone call. Regardless of your chosen path, you should know that acknowledging there is an issue and resolving to get started to rectify it is the first step.

Make a List & Check it Twice

To get yourself organized at the start, make a list of all your debtors–those who you are paid up to date as well as those which are past due. This will give you an idea of your total debt owing and a starting point to make a plan for action. Double check the list to ensure you haven’t forgotten anyone, even from years ago which may have gone to collections.

Gather All Notices/Past Due Invoices/Collection Letters

Once you have your list in hand, you can begin to gather your notices which should outline your outstanding amounts. Along with having these actual totals in front of you, these will tell you the correct name, spelling and address of who and where to make payments. If any of your accounts have gone to collection agencies, you will be dealing with them instead of your original creditors.

Debt Consolidation

This is one option you have available to you to get your affairs in order. Debt consolidation means you acquire one large loan to pay off your numerous smaller debts. By doing so, you only have one payment to make each month instead of multiples. Paying one loan instead of many means you also save money on the interest you are paying every month, making it virtually impossible to pay off those various debts. There are services to assist with debt consolidation such as found at spergel.ca/debt-help/debt-consolidation, where professionals will assist you in getting that loan to help reduce and eventually eliminate your debt load.

Credit Counselling

Usually offered at a minimal fee, credit counsellors contact your debtors on your behalf and request a freeze on the interest you are currently paying, in order to help get the balance paid down. In some cases, they may even negotiate a lower outstanding payable balance, allowing you to pay less of what you owe.

Bankruptcy

As a final solution, one that shouldn’t be taken lightly, bankruptcy is an option to help you get your finances back under control. You will need to fill out various forms, potentially take courses or classes and disclose all of your assets before a bankruptcy goes through. It is best to have a professional working on your side to assist with the process and walk you through the requirements to reduce confusion. This will remain on our credit rating for several years so you will have to rebuild your credit after your bankruptcy has been fully discharged. It is important to note, you may have to surrender some of your assets if you opt to file for bankruptcy. It is best to seek professional advice for your specific situation.